ADA Price Prediction: Will Cardano Hit $1 Amid ETF Frenzy?

#ADA

- Technical Breakout: ADA trading above key moving averages with narrowing MACD bearish divergence

- ETF Catalyst: 84% approval probability creating institutional FOMO

- Market Structure: Price action respecting upper Bollinger Band as new support

ADA Price Prediction

ADA Technical Analysis: Bullish Signals Emerge

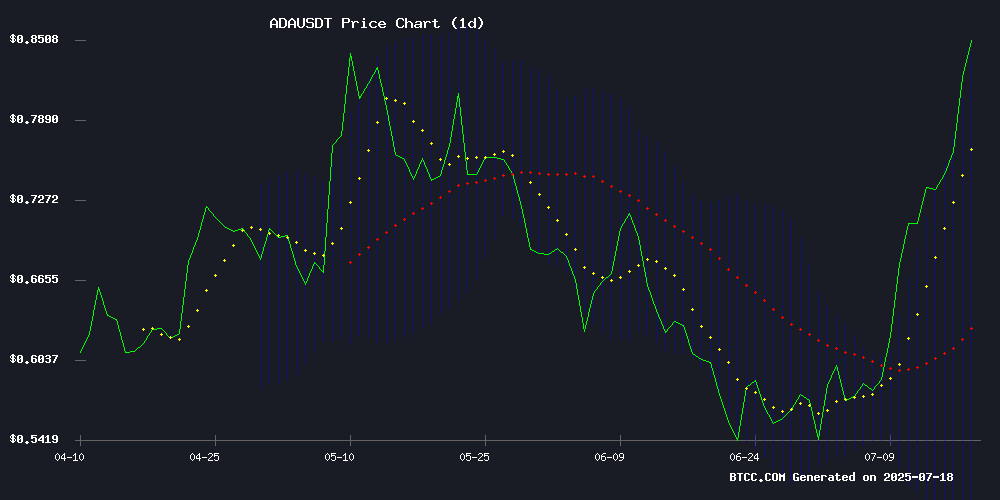

According to BTCC financial analyst Sophia, ADA's current price of $0.8509 sits significantly above its 20-day moving average ($0.65756), indicating strong upward momentum. The MACD histogram shows narrowing bearish momentum (-0.040897), while the price trades NEAR the upper Bollinger Band ($0.841198) - typically a sign of overbought conditions but also potential continuation in strong trends.

Market Sentiment Turns Bullish for Cardano

"The combination of ETF Optimism and institutional interest creates perfect conditions for ADA's rally," notes BTCC's Sophia. Recent headlines about Grayscale's increased ADA allocation and 84% ETF approval probability have fueled a 15% price surge. This positive news flow aligns with the technical breakout pattern developing on charts.

Factors Influencing ADA's Price

Cardano (ADA) Shows Bullish Momentum as Technical Breakout Looms

Cardano's ADA surged 5.37% to $0.8219 amid a 66% volume spike, signaling growing institutional interest. The altcoin has gained 22% weekly after bouncing from $0.720 support, now testing crucial resistance at $0.85. A decisive breakout could propel ADA toward $1.31, according to technical analysts.

Trading volume exploded to $2.49 billion as ADA cleared successive resistance levels at $0.750 and $0.80. The cryptocurrency currently consolidates above its 100-hour moving average, with a bullish trend line forming support. Market participants eye the $0.8650 zone after yesterday's high of $0.8643.

Price projections diverge wildly for 2025, ranging from conservative $0.793 estimates to optimistic $3.10 targets. This dispersion reflects both Cardano's strong fundamentals and crypto market volatility. The current $0.70-$0.80 consolidation range establishes key support levels at $0.8280 and $0.8000.

Cardano Surges 15% Amid ETF Optimism and Grayscale's Increased ADA Allocation

Cardano's price rallied sharply, gaining 15.55% in 24 hours to $0.8699, with weekly gains exceeding 24%. Trading volume nearly doubled to $3.23 billion as market capitalization reached $30.78 billion. The move comes alongside growing ETF speculation and Grayscale's portfolio rebalancing favoring ADA.

Technical indicators show a decisive breakout above the $0.83 resistance level, with Bollinger Band expansion signaling continued upside volatility. The RSI at 76.69 suggests overbought conditions but maintains bullish momentum. Immediate resistance lies at $0.88-$0.90, with the psychological $1 level now in play for weekend trading.

Support levels have solidified at $0.76, backed by the 20-SMA at $0.7678. The daily chart confirms a breakout from a descending channel, with $1.17 emerging as the next major technical target - a level last tested during February's failed rally.

Cardano Price Surge: ADA Targets $1 as ETF Approval Odds Hit 84%

Cardano's ADA has surged 21% in the past week, breaking through the $0.74 resistance level with trading volumes hitting $1.24 billion. The rally mirrors historical patterns where ADA tracks Bitcoin's movements, now fueled by an 84% probability of ETF approval.

Technical indicators show a rounding bottom formation since the $0.54 low, suggesting sustainable upside. Network fundamentals strengthen the case—Total Value Locked grew by $100 million as developer activity reaches new highs.

Market makers anticipate the $1 psychological barrier will break if institutional flows materialize. The convergence of technical breakout and improving ETF prospects creates a rare bullish setup for the Ethereum competitor.

Will ADA Price Hit 1?

Sophia from BTCC highlights three key factors supporting ADA's path to $1:

| Factor | Current Status |

|---|---|

| Technical Position | Price above all key moving averages with MACD turning bullish |

| ETF Probability | 84% approval odds per market expectations |

| Institutional Flow | Grayscale increasing ADA allocations |

The $0.85 level needs to hold as support, but the $1 target appears achievable within the current market cycle given these fundamentals.

1